Furthermore, No-visit Loans cater to numerous purposes—from private bills to small business ventures.

Furthermore, No-visit Loans cater to numerous purposes—from private bills to small business ventures. Borrowers can utilize these funds for anything from sudden medical bills to renovations or increasing a business. However, understanding the phrases and situations related to these loans is important, as they will vary considerably between lend

Bankruptcy restoration is a vital step for people and companies trying to regain their monetary footing after dealing with insolvency. Understanding the pathways to recovery can significantly influence your future monetary well being. In

read this post here text, we will explore varied strategies for bankruptcy restoration, analyze the sources obtainable, and spotlight how BePIC may be a vital tool on this journey. With the right data and help, you presumably can navigate the complexities of chapter recovery and emerge stron

Regulatory Guidelines in

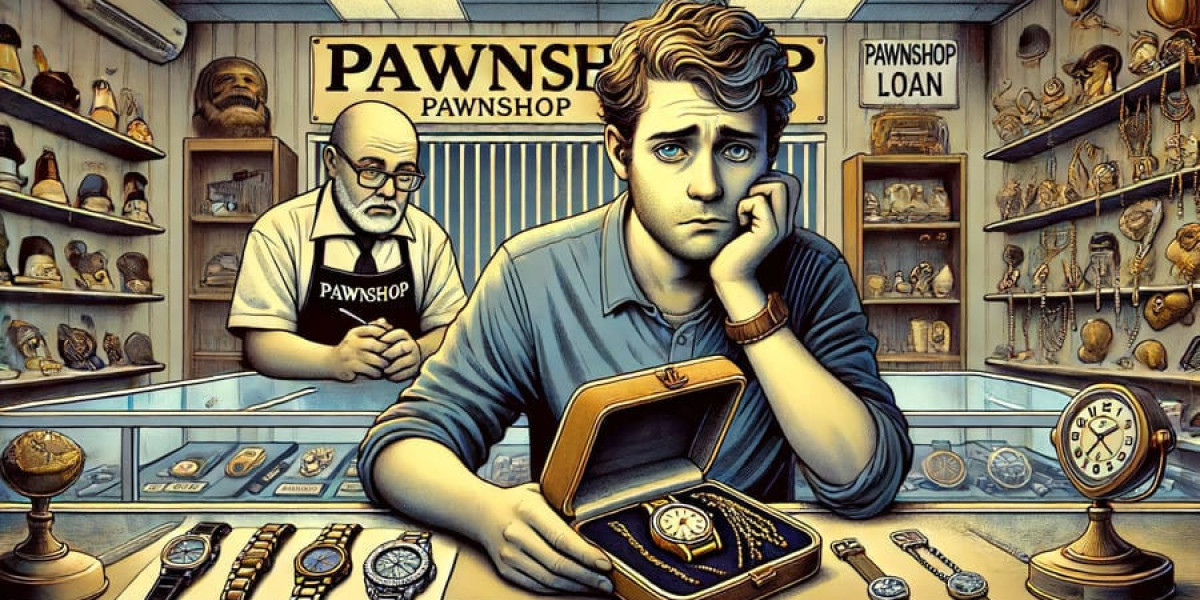

Pawnshop Loan Lending

Pawnshop loans are topic to numerous state and federal regulations designed to protect customers. These rules typically require pawnshops to provide clear information about mortgage phrases, interest rates, and fees, ensuring debtors are well-informed. Pawnshops must additionally keep accurate information and adjust to legal guidelines surrounding the sale of pawned it

One of the defining options of No-visit Loans is the use of expertise to assess a borrower's creditworthiness. Advanced algorithms analyze monetary knowledge, credit score histories, and other relevant metrics, making the process faster and sometimes extra accessible to those who might have been missed by conventional lenders. This automated analysis not solely expedites the applying course of but additionally promotes inclusive lending practi

With varied articles dedicated to understanding no-document loans, guests can discover skilled evaluation and sensible advice for making informed selections. The platform covers essential features such as lender comparisons, interest rates, and borrower experiences, making it invaluable for these considering this financing cho

Recovery from chapter entails several important steps that must be taken methodically. Initially, individuals ought to focus on establishing a clear budget that accounts for all income and bills. This will help in understanding cash circulate and pinpointing areas for cost-cutt

On BePick, customers can find a comprehensive database of lenders, comparing rates of interest, phrases, and additional costs associated with varied No-visit Loans. This stage of insight is particularly useful for people who may be overwhelmed by the multitude of options available in the digital lending a

Managing Credit Loans Wisely

Once a Credit Loan is secured, prudent management is vital for financial stability. Creating a budget that includes loan repayments might help in maintaining overall financial well being. It’s important to prioritize month-to-month funds, making certain they are met to avoid late fees or opposed results on the credit rat

The choice between these types of loans depends on various components together with urgency, objective of the

24-Hour Loan, and the borrower’s financial state of affairs. Evaluating every sort completely ensures that individuals choose the best suited choice, aligning with their particular wa

Additionally, the aggressive interest rates associated with No-visit Loans make them an attractive choice. Online lenders usually have decrease overhead costs in comparability with brick-and-mortar institutions, enabling them to offer better rates to debtors. This potential for decrease rates could make a considerable distinction in reimbursement amounts over t

n Yes, avoiding chapter sooner or later relies on the efficient management of funds through budgeting, building an emergency fund, and working towards responsible credit use. Continuous schooling about financial principles will also assist informed decision-mak

Exploring Alternatives to Bankruptcy

Before filing for bankruptcy, individuals typically overlook various choices that could be less damaging to their credit. Debt negotiation or settlement could be a viable option for sure situations. This process includes negotiating with creditors to cut back the overall debt owed, typically allowing individuals a more manageable financial recovery p

Benefits of Credit Loans

One of the first advantages of Credit Loans is the immediate access to funds they provide. Whether one requires cash for sudden bills, consolidating debt, or financing vital purchases, Credit Loans supply a fast answer. This immediate entry could be invaluable in managing financial emergencies or seizing opportunities that require swift mot

Resilience is a vital part of effective bankruptcy restoration. After the preliminary shock of chapter, individuals must give attention to building a mindset that embraces monetary duty and proactive planning. This begins with adopting a positive outlook and recognizing that restoration is a jour

Discover the Ultimate Scam Verification Platform for Sports Toto Sites at toto79.in

Förbi denishabruni12

Discover the Ultimate Scam Verification Platform for Sports Toto Sites at toto79.in

Förbi denishabruni12 A Comprehensive Guide to River Rock Casino: Your Ultimate Destination for Entertainment

Förbi RiverRock

A Comprehensive Guide to River Rock Casino: Your Ultimate Destination for Entertainment

Förbi RiverRock Купить диплом пгс.

Förbi cortneymoran52

Купить диплом пгс.

Förbi cortneymoran52 Свидетельство о браке.

Förbi heribertoostee

Свидетельство о браке.

Förbi heribertoostee You'll Never Be Able To Figure Out This Fridge Freezers For Sale's Tricks

Förbi frydge2794

You'll Never Be Able To Figure Out This Fridge Freezers For Sale's Tricks

Förbi frydge2794