No-visit loans represent a revolutionary approach to safe funds with out the need to meet with a lender in person.

No-visit loans represent a revolutionary approach to safe funds with out the need to meet with a lender in person. This progressive financial service presents convenience and accessibility, significantly in at present's fast-paced world. By eliminating the traditional obstacles of in-person appointments, customers can now entry loans from the comfort of their homes. No-visit loans have gained reputation because of their flexibility and the benefit with which borrowers can apply. Additionally, the growing reliance on digital solutions further enhances the appeal of no-visit lending. Such processes streamline the borrowing expertise, allowing users to focus on their monetary needs without the added stress of scheduling conferen

Private Student Loans

Many students flip to non-public loans when federal help falls short. Private scholar loans differ extensively primarily based on the lender's phrases and circumstances, so it's essential to check choices before committing. While these loans may help shut funding gaps, debtors ought to be conscious of potential pitfa

Despite the rising recognition of no-visit loans, a quantity of misconceptions persist. One frequent fable is that these loans are only available to those with excellent credit scores. In actuality, many lenders accommodate various credit score profiles, making these loans accessible to a broader view

Typically, worker loans are thought of internal loans and may not be reported to non-public credit score bureaus like traditional loans. However, late payments can result in penalties throughout the organization and probably affect future borrowing capabilities. It's crucial to stay aware of your reimbursement obligati

Implementing a price range and considering dwelling bills, along with mortgage payments, might help avoid missed funds, which may Other Loans lead to penalties and damage your credit score rating. It might also be beneficial to discover alternatives for mortgage forgiveness, especially for those in public service care

However, there are alternatives similar to Income-Driven Repayment (IDR) Plans, which adjusts month-to-month payments based on income and household size. This can alleviate financial strain, especially for these in lower-paying j

Furthermore, employee loans can position an employer as a aggressive entity in the job market. Offering such benefits can appeal to top talent, especially amongst younger generations who worth complete worker assistance programs. This can enhance the organization's reputation and contribute to a collaborative setting where employees feel valued and suppor

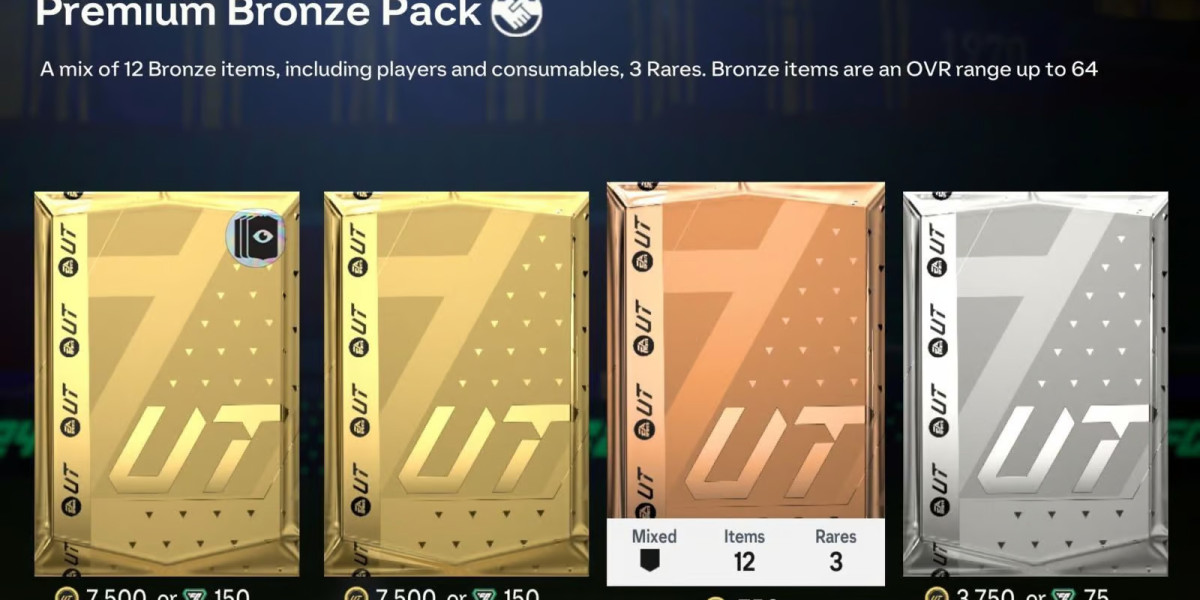

Each option comes with its own set of terms and conditions, which is why it's important to check different solutions fastidiously. Factors such as interest rates, reimbursement phrases, and fees must be analyzed to determine the most suitable financial prod

Additionally, BeaPick often updates its content material, guaranteeing users have access to the newest information concerning interest rates, lender choices, and business tendencies. As a reliable information, BeaPick strives to simplify the journey of acquiring actual property lo

Through detailed reviews and user experiences, BeaPick empowers customers with insights that facilitate knowledgeable decision-making. The web site offers comparability instruments that allow users to contrast totally different mortgage merchandise facet by side, demonstrating the advantages and drawbacks of e

Risks Associated with Mobile Loans

Despite their advantages, cell loans do come with sure dangers. One of essentially the most important concerns is the potential for high-interest charges, significantly with payday loans or short-term emergency financing. It's important for debtors to be vigilant about understanding the total cost of borrowing earlier than committing to a mortg

Additionally, understanding the terms outlined in the mortgage settlement is essential. Each

Monthly Payment Loan loan might include circumstances concerning late payments, early repayment fees, and other stipulations that can impression the borrowing expertise. Therefore, cautious evaluate of the mortgage contract is advisable earlier than sign

Furthermore, these loans can often be accessed relatively quickly, providing quick financial relief to these in want. Many lenders present online functions, making the method handy. If approved, the loan quantity could be disbursed within a couple of days, providing essential funds for urgent purchases or consolidating current de

Understanding Employee Loans

Employee loans are monetary preparations supplied by an employer to their staff, permitting them to borrow money underneath specified terms. Unlike conventional lending, which regularly involves external banks or credit score unions, worker loans are usually

Other Loans managed internally throughout the group. This can widen access for employees who may face challenges qualifying for conventional loans. For each the worker and employer, understanding the framework and implications of worker loans is essent

Discover the Ultimate Scam Verification Platform for Sports Toto Sites at toto79.in

کی طرف سے denishabruni12

Discover the Ultimate Scam Verification Platform for Sports Toto Sites at toto79.in

کی طرف سے denishabruni12 A Comprehensive Guide to River Rock Casino: Your Ultimate Destination for Entertainment

کی طرف سے RiverRock

A Comprehensive Guide to River Rock Casino: Your Ultimate Destination for Entertainment

کی طرف سے RiverRock Купить диплом пгс.

کی طرف سے cortneymoran52

Купить диплом пгс.

کی طرف سے cortneymoran52 Свидетельство о браке.

کی طرف سے heribertoostee

Свидетельство о браке.

کی طرف سے heribertoostee You'll Never Be Able To Figure Out This Fridge Freezers For Sale's Tricks

کی طرف سے frydge2794

You'll Never Be Able To Figure Out This Fridge Freezers For Sale's Tricks

کی طرف سے frydge2794